10 questions to ask yourself before choosing health insurance for expatriates

Take the time to fully understand the terms and conditions of your health insurance before taking out your policy, to make sure you make the best choice for your needs and budget.

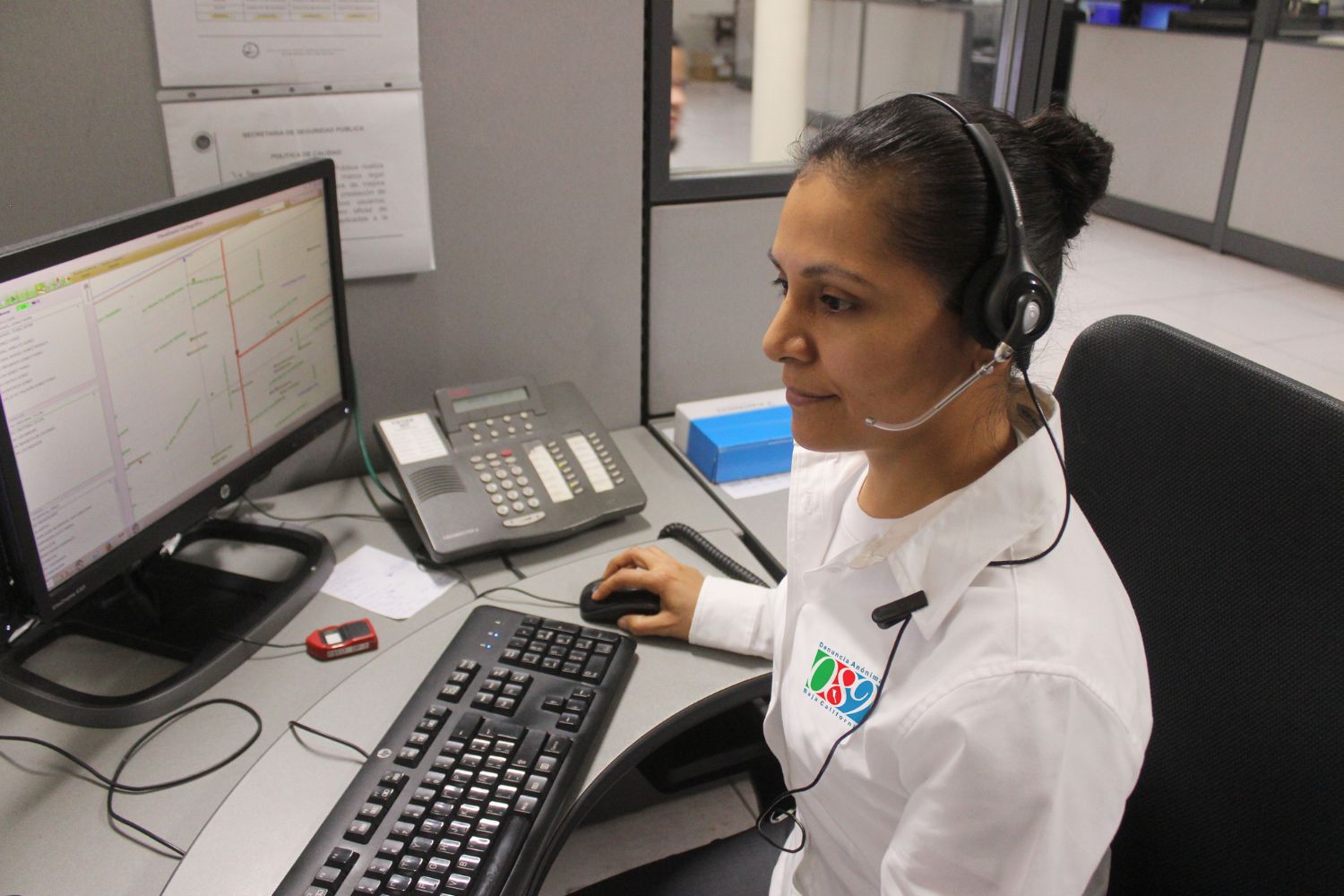

1 – Is it possible to benefit from 24/7 emergency medical assistance?

Having 24/7 emergency medical assistance can be a source of comfort for expatriates living in a foreign country where the healthcare systems may be different from what they are used to.

As an expatriate, it is important to have access to medical assistance in the event of an emergency, whatever the time of day or day of the week. Emergency medical assistance can include a variety of services, such as telephone medical assistance to help policyholders find local doctors or healthcare facilities in an emergency, coordination of medical care in the event of illness or accident, emergency medical transport, or medical evacuation to an appropriate healthcare centre.It is important to check whether emergency medical assistance is included in the basic insurance cover or whether it requires you to take out an additional option.

2 – Does the insurance cover repatriation costs in the event of a medical emergency or death?

When you take out expatriate health insurance, check that it covers repatriation costs in the event of a medical emergency or death. Medical repatriation can be very expensive, especially if it has to be carried out over long distances or requires specialised transport.

If you fall ill or are injured abroad, your expatriate health insurance may cover the cost of medical care necessary for your local treatment. However, if you require specialist treatment or major surgery that is not available locally, your insurer may consider repatriating you to your home country.Similarly, in the event of the death of an expatriate abroad, the costs of repatriating the deceased can be very high. In this case, expatriate health insurance can cover the cost of repatriating the body to the country of origin.

3 – Which countries are covered by expatriate health insurance?

It is important to check whether the countries you plan to visit or work in are covered by expatriate health insurance.If you plan to travel to several countries or change your country of residence during your expatriation period, you need to make sure that your expatriate health insurance offers worldwide cover or cover tailored to your specific needs, particularly in countries where the cost of medical care is high.For example, some countries in Asia or North America may have very high healthcare costs compared to countries in Europe or Latin America. If you are planning to work or travel in these countries, it may be wise to check whether your expatriate health insurance provides adequate cover for these destinations.

Secure your health abroad with the best expatriate health insurance plan. Get a quote now!

4 – How are medical expenses reimbursed?

If you are an expatriate, it is useful to know how the insurer handles claims for reimbursement of medical expenses when you are abroad. Will you have to pay in advance, or will the insurer pay the care providers directly?

The little extras include language and assistance. Golden Care offers a multilingual helpline, which can help you find local healthcare providers and manage medical claims. It’s also important to check whether the insurer has a translation service for medical documents to make claims easier.

5 – What are the benefits and exclusions of the medical cover offered by the insurer?

This is a key question for expatriates. Medical cover benefits correspond to the medical expenses covered by the insurance. They may vary depending on the type of medical cover. Here are a few examples of cover that may be offered:

- Consultations with a general practitioner or specialist.

- Hospitalisation costs.

- Pharmaceutical costs and prescribed medicines.

- X-ray and medical imaging costs.

- Emergency dental treatment.

- Emergency medical repatriation costs.

Exclusions from medical cover correspond to medical expenses that are not covered by the insurance.

Exclusions may relate to medical treatment not authorised by the insurer, or to beauty care or cosmetic surgery. It is therefore important to fully understand the benefits and exclusions of the medical cover offered by the insurer before taking out expatriate health insurance. This will enable you to choose cover that meets your needs and avoid unpleasant surprises if you need medical treatment abroad. It is advisable to take the time to read the terms and conditions of the cover offered carefully, and to ask the insurer questions if you have any doubts.

6 – How much does expatriate health insurance cost?

The cost of expatriate health insurance can vary considerably from one insurer to another and will depend on a number of factors, including the cover offered, the duration of cover, the age of the policyholder, the geographical destination, the excess, etc. In general, premiums for expatriate health insurance are higher than for national health insurance, due to the increased risk associated with healthcare cover in foreign countries. Take the time to study the premiums, excesses, cover, exclusions and reimbursement conditions to determine the best option for your needs. Please note: the cost of expatriate health insurance should not be the only criteria in your choice. The quality of the cover offered, the benefits, exclusions, reimbursement terms, etc., are also essential points to take into account to determine the best option for your specific needs.

7 – What are the reimbursement ceilings for different types of care (consultations, hospitalisation, medication, etc.)?

Reimbursement ceilings correspond to the maximum amount that the insurer will reimburse for each type of treatment covered by the medical cover. These ceilings can have a significant impact on the total cost of medical care for expatriates. Here are some examples of reimbursement limits for different types of treatment:

- Medical consultations: The ceiling is set according to the doctor’s speciality and the place of consultation.

- Hospitalisation: the reimbursement ceiling for hospitalisation may be set according to the type of room (single or shared) and the country of hospitalisation.

- Medicines: the reimbursement ceiling for medicines may be limited to a certain amount per day or per prescription.

- Dental care: the reimbursement ceiling for dental care may be set according to the type of care, such as cosmetic dentistry or dental surgery. Accidents are usually fully covered by a majority of international insurances

8 – What are the waiting periods?

Waiting periods are an important aspect to consider when choosing health insurance for expatriates. The waiting period is the period during which the insurer will not cover the insured person’s medical expenses, even if they have already enrolled and started paying contributions. This means that if the policyholder needs medical treatment during this period, they will have to pay for the medical expenses out of their own pocket. However, some insurers offer medical cover with no waiting period.

This can be a major limitation for expatriates who need medical care as soon as they arrive in their host country. It is therefore advisable to check the waiting periods before taking out health insurance, and to have a back-up plan in case you need medical care during the waiting period.

9 – Are there any age limits for taking out expatriate health insurance?

The question of age limits is an important factor to take into account when looking for expatriate health insurance. In fact, each insurer has its own policy on the age limit for taking out expatriate medical cover.

What’s more, even if an insurer accepts applications from older people, insurance premiums may be higher for these people, who are more at risk of contracting illnesses.

Check the age limits in your policy before taking out expatriate health insurance, especially if you are over 50 or 60.

Finally, some expatriate health insurance policies may also have health requirements before accepting a policy. This means that people with pre-existing medical conditions may be excluded from medical cover or charged higher premiums. It is therefore important to check each insurer’s health policies before taking out expatriate health insurance.

10 – Does the insurance cover medical expenses in the event of a pre-existing illness?

The question of cover for medical expenses in the event of a pre-existing illness is important for people who already have a medical condition before taking out expatriate health insurance. A pre-existing condition is a medical condition that has been diagnosed before the insurance is taken out. This could be a chronic illness, such as diabetes, high blood pressure or heart disease.

Make sure that your expatriate health insurance covers medical expenses in the event of a pre-existing illness and, if so, to what extent. Some insurances exclude pre-existing conditions from their cover, while others offer limited cover or require a waiting period before covering medical expenses related to the pre-existing condition.

In some cases, expatriate health insurance may offer full cover for pre-existing conditions, but this may result in a higher insurance premium. It is therefore important to check the conditions of cover to ensure that you are covered for your medical needs.

Look closely at each insurer’s definitions of pre-existing conditions, as they may vary from one to another. Some insurance companies may consider a pre-existing condition to be one that was diagnosed or treated in the 12 months prior to taking out the insurance, while others may have a longer reference period.

Finally, some insurance companies may only offer cover for pre-existing conditions if the insured meets certain conditions, such as a medical examination or a detailed health questionnaire. It is therefore important to check the conditions of cover offered by each insurer before taking out expatriate health insurance.

You may be interwsted in these posts

How do you deal with an accident or illness when on holiday abroad?

An accident or illness in the middle of your holiday can quickly become a real headache for both your organisation and your budget. Between the cost of medical care, the language barrier and the lack of reference points, travellers who have not taken out international health insurance before going on holiday abroad are often at […]

Using BioHacking to improve your health

To live better, certainly, but in the best conditions, such is the challenge that Humanity is about to take up. Facing the limits of modern medicine, more and more people are turning to BioHacking to improve their health and optimize their performance. Discover the concrete practices and methods to implement in your daily life to […]